Visual Paradigm Desktop |

Visual Paradigm Desktop |  Visual Paradigm Online

Visual Paradigm OnlineAn online banking system gives customers secure, convenient access to manage accounts, make transfers, and pay bills, while ensuring compliance and data protection. This example shows how the use case description generator organizes financial services into structured use cases and diagrams.

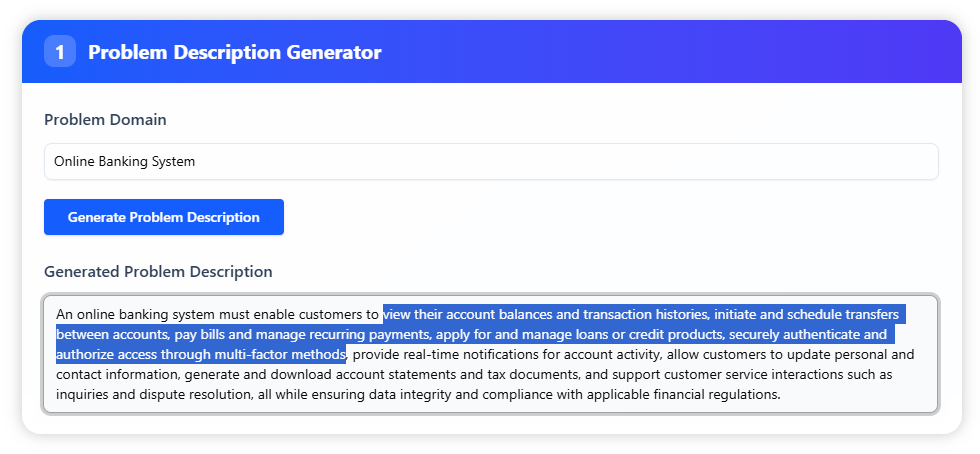

Enter Online Banking System as the problem domain. The tool creates a comprehensive and editable problem description, covering account management, fund transfers, bill payments, loan applications, authentication, notifications, and dispute resolution. You can refine the description to reflect your bank’s policies and services.

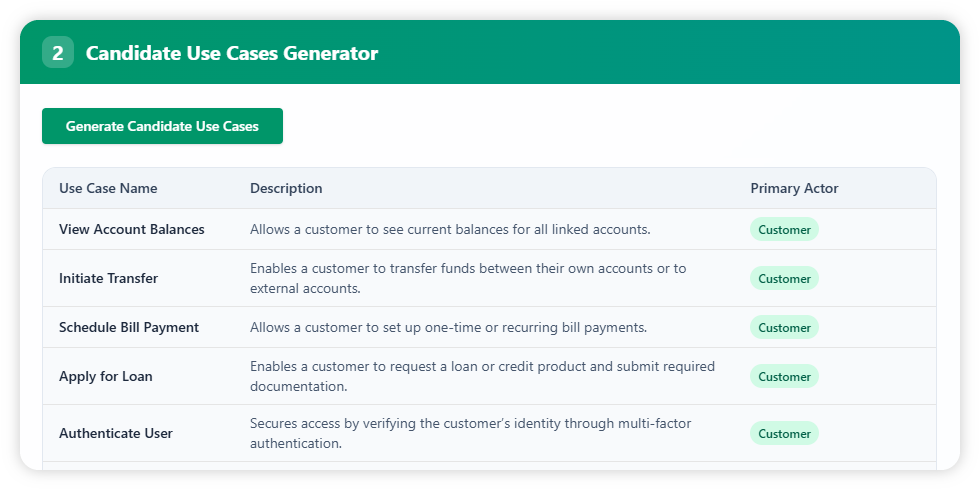

Click the “Generate Candidate Use Case” button to produce a set of candidate use cases with their name, description, and primary actor. For this case, the use cases include viewing account balances, initiating transfers, scheduling bill payments, applying for loans, authenticating users, generating statements, updating personal information, and resolving disputes.

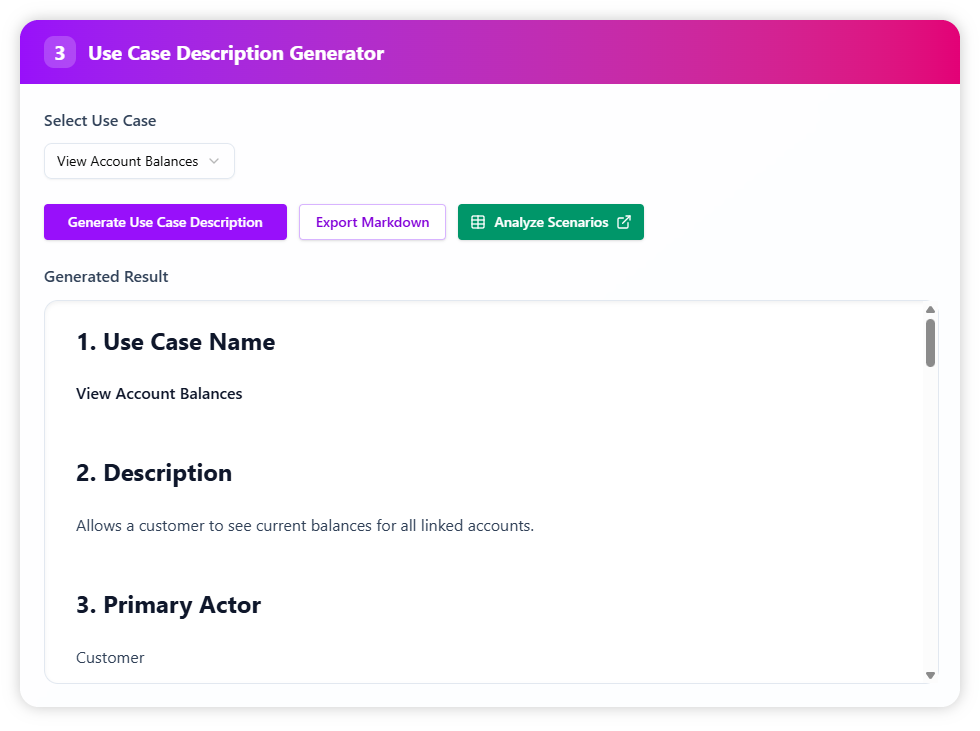

Select one use case for detailed expansion. In this example, the chosen case is View Account Balances. The tool generates a structured description with preconditions, main flow, alternative flows, and exceptions, giving a complete picture of how customers access balance details. The description can also be exported in Markdown format for documentation and compliance report.

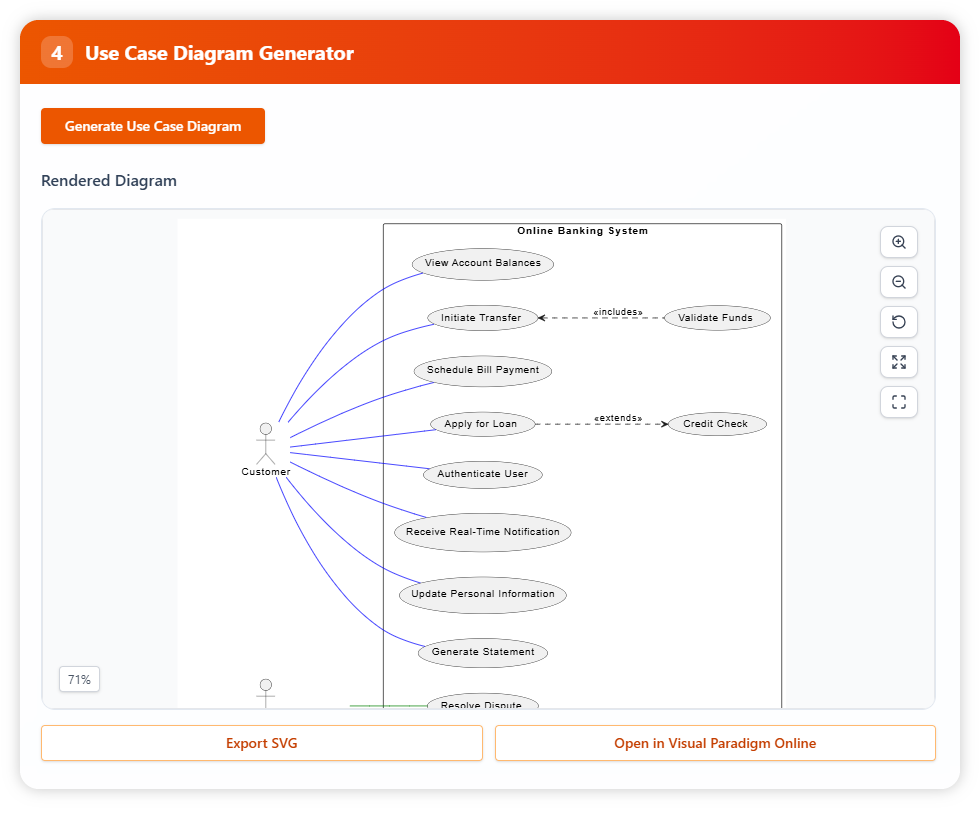

Finally, generate a use case diagram that shows customers, authentication mechanisms, and support staff interacting with banking functions. The diagram can be exported as an SVG file or opened directly in Visual Paradigm Online for editing and collaboration.