Visual Paradigm Desktop |

Visual Paradigm Desktop |  Visual Paradigm Online

Visual Paradigm OnlinePorter’s Five Forces Framework is a tool for analyzing the level of competition within an industry. It highlights the structural drivers of profitability and identifies how external factors influence a company’s ability to earn above-average returns.

Unlike internal analysis models such as SWOT, the Five Forces framework is outward-looking. It examines the entire market ecosystem, giving leaders a structured way to anticipate threats, recognize opportunities, and design strategies that improve competitive positioning.

1. Threat of New Entrants

The first force measures how easy it is for new companies to enter an industry and compete with existing businesses.

High threat occurs when entry barriers are low: little startup capital is needed, no government regulations apply, and customers can switch brands easily.

Low threat exists when it takes significant investment, specialized expertise, or strong brand reputation to compete.

Example: The airline industry has high entry barriers due to aircraft costs, safety regulations, and slot restrictions. In contrast, online retail has lower entry barriers, allowing startups to launch quickly.

2. Bargaining Power of Suppliers

Suppliers influence profitability by controlling prices, availability, and quality of inputs.

If a few suppliers dominate the market or offer unique resources, their power is high.

When many suppliers exist, or alternatives are easy to source, their power is low.

Example: Semiconductor suppliers like TSMC or Intel hold high bargaining power because of limited global alternatives. On the other hand, in agriculture, where many small suppliers compete, buyer companies usually hold the power.

3. Bargaining Power of Buyers

Customers also affect profitability by demanding better quality, lower prices, or additional services.

High buyer power arises when customers have many choices, switching costs are low, or they purchase in bulk.

Low buyer power happens when options are limited, or products are highly differentiated.

Example: In the fast-food industry, customers can easily switch between brands like McDonald’s and Burger King, giving them high bargaining power. In luxury fashion, however, unique designs and strong brand value reduce buyer influence.

4. Threat of Substitutes

A substitute is a product or service that satisfies the same need in a different way. Substitutes can limit industry growth by drawing customers away.

High threat exists when alternatives are cheaper, better, or more convenient.

Low threat occurs when no viable substitutes are available.

Example: Video conferencing tools like Zoom have become substitutes for business travel. Similarly, plant-based meat is a growing substitute for traditional meat products.

The strength of the framework lies in its ability to simplify complex market conditions into five clear categories. Companies use it to:

Evaluate industry attractiveness before entering new markets.

Identify profit pressures that could undermine performance.

Prioritize strategic initiatives such as cost leadership, differentiation, or partnerships.

Anticipate future changes in the business landscape.

Ultimately, the Five Forces model helps you answer a critical question: Is this industry worth competing in, and if so, how can we succeed?

Market Entry Decisions

Startups and investors often use the framework to determine whether entering a new industry is viable. If supplier power and rivalry are too high, the risks may outweigh the benefits.

Competitive Benchmarking

Existing firms apply the model to evaluate where they stand relative to competitors. For instance, identifying substitute threats may encourage product innovation.

Risk Management

By mapping external forces, companies can foresee vulnerabilities — such as dependency on a few suppliers — and develop contingency plans.

Long-Term Strategy

The framework supports high-level decisions, such as diversification, mergers, or exiting a declining market.

Even though the model was developed more than 40 years ago, it remains widely used in today’s fast-changing environment. Digital transformation, globalization, and shifting consumer behavior have made external forces even more critical.

E-commerce lowers entry barriers but increases rivalry.

Global supply chains raise supplier risk and bargaining power.

Sustainability concerns drive new substitutes, like renewable energy or eco-friendly packaging.

Technology adoption reshapes buyer expectations and intensifies competition.

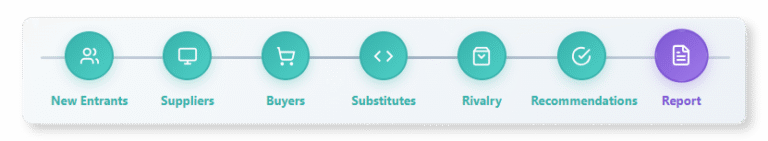

Modern tools such as the Porter’s Five Forces Analyzer make applying the framework easier by guiding you step by step, storing your data, and producing professional reports instantly.