Visual Paradigm Desktop |

Visual Paradigm Desktop |  Visual Paradigm Online

Visual Paradigm OnlineWhen you’re evaluating a project, focusing only on total profits can be misleading. A dollar you receive today holds more value than a dollar you’re promised five years from now, due to factors like inflation and potential investment opportunities. This core principle, known as the time value of money, is what makes Net Present Value (NPV) such a powerful tool for financial analysis. NPV calculates the difference between the present value of future cash inflows and the present value of cash outflows over a specific period. In simpler terms, it tells you a project’s value in today’s dollars.

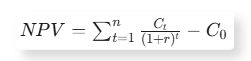

The calculation of NPV requires you to “discount” future cash flows back to their present value using a specific rate, often your company’s cost of capital. The formula looks like this:

A positive NPV indicates that the project is expected to generate more value than it costs, making it a potentially profitable venture. A negative NPV suggests the project will lose money, while an NPV of zero means it is expected to break even.

While simple metrics like Return on Investment (ROI) are easy to understand, they have a major limitation: they don’t account for the timing of cash flows. NPV, on the other hand, provides a more accurate picture of a project’s true profitability by incorporating the time value of money. This makes it an ideal tool for comparing long-term projects with different cash flow patterns or for deciding between two projects with similar ROIs but different timelines. By using a consistent discount rate, NPV allows you to compare projects on a level playing field and prioritize those that offer the greatest value today.

To get the most out of an NPV analysis, it’s essential to use realistic cash flow projections and an accurate discount rate. These are the two most critical inputs, and getting them right is key to a valid result.

While NPV is more complex than a simple ROI calculation, using a dedicated financial tool can automate the process, helping you perform a robust analysis quickly and reliably.

By making NPV a key part of your decision-making process, you can move beyond simple guesswork and start making truly evidence-based financial decisions that align with your long-term strategic goals. This approach ensures your investments are not just profitable, but are also the best possible use of your company’s capital.

Once you have your NPV value, what does it mean? A positive NPV means the project is expected to be profitable and should be considered for investment. A negative NPV, however, indicates a project that will likely result in a net loss and should be rejected. When comparing multiple projects, the one with the highest positive NPV is typically the most financially attractive option. Using NPV in this way allows you to confidently rank investment opportunities based on their ability to generate real, present-day value for your business.